Singlife Multipay Critical Illness (previously known as Aviva My MultiPay Critical Illness Plan IV) is a competitive early critical illness plan with claims payable for all stages of critical illnesses. This early critical illness plan from Singlife also has the highest multiple payout features at 900% of your Sum Assured.

Singlife Multipay Critical Illness product details

Singlife Multipay Critical Illness is featured for multiple insurance claim benefits in our 5 Best Early Critical Illness Plans in Singapore (2023 Edition)

- Non-participating policy – Term policy

- Provides you with up to 6 lump sum payouts upon diagnosis of Critical Illnesses (CI) across Early, Intermediate, or Severe Stages including up to two payouts if re-diagnosed with cancer

- Multipay Critical Illness Insurance Coverage

- You are covered 900% of the Sum Assured against CIs in all stages as well as recurrent CIs

- 600% Early to Advance Stage CI

- 300% Recurrent CI

- You are covered 900% of the Sum Assured against CIs in all stages as well as recurrent CIs

- Advance Care Option

- Option to receive an additional 100% of the Sum Assured when receiving your claims for a Severe Stage CI. This will overturn the re-diagnosis benefits.

- Special Benefit

- Receive an additional 20% of the Sum Assured upon diagnosis of any one of the 27 conditions covered such as diabetes

- Claim up to 6 times for different medical conditions covered under the Special Benefit

- Receive an additional 20% of the Sum Assured upon diagnosis of any one of the 27 conditions covered such as diabetes

- Benign and Borderline Malignant Tumour Benefit

- An additional payout of up to 20% of the Critical Illness Benefit sum assured (up to $25,000) upon a completed surgical removal of a benign tumor (suspected malignancy).

- Intensive Care Benefit

- An additional payout of up to 20% of the Critical Illness Benefit sum assured (up to $25,000) if you were admitted to and stayed in an Intensive Care Unit (ICU) for 4 days or more

- Death Benefit

- A lump-sum payout of $5,000 upon the death of the life insured will be paid out to the deceased’s family

- Coverage Term

- You can choose to be covered from 10 years to 99 years old

- Flexibility of Currency

- You can choose to pay in SGD, USD, GBP, EUR, AUD or HKD

- Premium Waiver Benefit

- Have all your future premiums waived upon diagnosis of Severe Stage CI or once you have claimed 300% of your sum assured or more

Read About: Term Policy: How does it work?

Read About: 3 things to consider before taking up a new financial product

Features of Singlife Multipay Critical Illness at a glance

Cash and Cash Withdrawal Benefits

Cash value: No

Cash withdrawal benefits: No

Health and Insurance Coverage

Death: Yes

Total Permanent Disability: No

Terminal Illness: Yes

Critical Illness: Yes

Early Critical Illness: Yes

Health and Insurance Coverage Multiplier

Death: No

Total Permanent Disability: No

Terminal Illness: No

Critical Illness: Yes

Early Critical Illness: No

Optional Add-on Riders

NA

Additional Features and Benefits

Yes.

For further information and details, refer to Singlife website. Alternatively, fill up the form below and let us advise accordingly.

Read Also: No budget for financial planning?

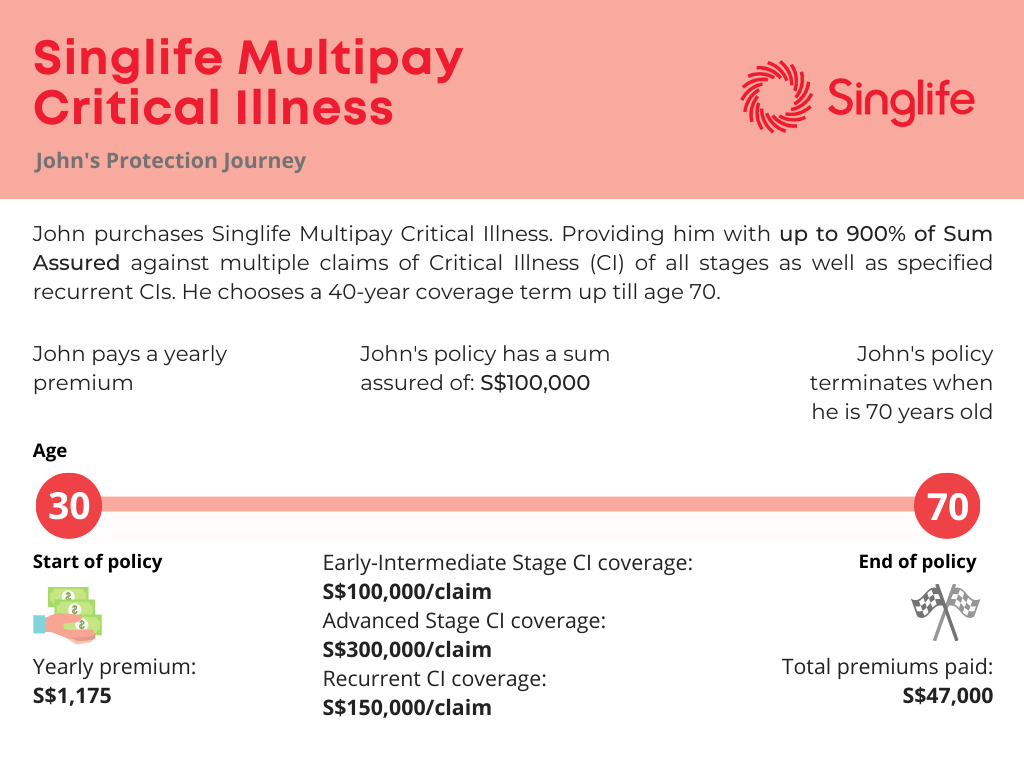

Policy Illustration for Singlife Multipay Critical Illness, John

John, age 30, purchases Singlife Multipay Critical Illness with a Sum Assured of S$100,000. He chooses a coverage term of 40 years with a yearly premium of S$1,175.

John is covered up to S$900,000 of the Sum Assured against multiple claims of critical illness across all stages as well as recurrent critical illnesses.

If John makes a successful claim for severe stage Critical Illness amounting to 300% of the Sum Assured, all future premiums will be waived.

With a total of S$47,000 paid in premiums. At age 70, John is healthy and his policy terminates with no cash value as Singlife Multipay Critical Illness is a term life policy.

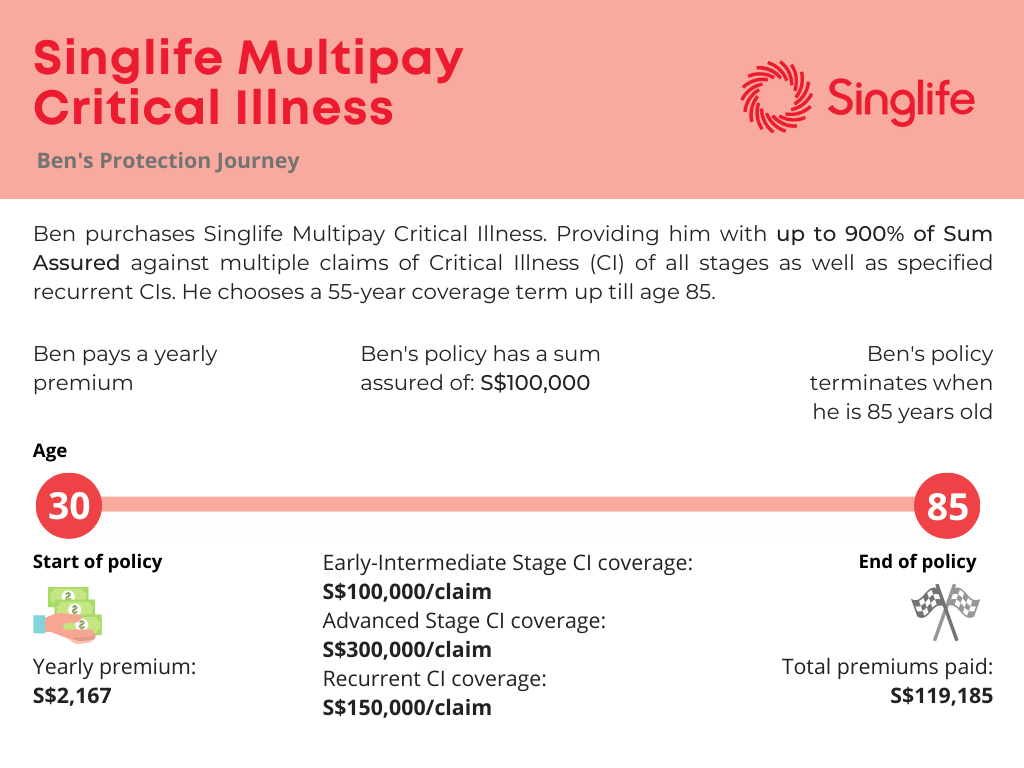

Policy Illustration for Singlife Multipay Critical Illness, Ben

Ben, age 30, purchases Singlife Multipay Critical Illness with a Sum Assured of S$100,000. He chooses a coverage term of 55 years with a yearly premium of S$2,167.

Ben is covered up to S$900,000 of the Sum Assured against multiple claims of critical illness across all stages as well as recurrent critical illnesses.

If Ben makes a successful claim for severe stage Critical Illness amounting to 300% of the Sum Assured, all future premiums will be waived.

With a total of S$119,185 paid in premiums. At age 85, Ben is healthy and his policy terminates with no cash value as Singlife Multipay Critical Illness is a term life policy.

Singlife Multipay Critical Illness may be suitable if you are looking for

Singlife Multipay Critical Illness may potentially be a good fit if the following matters to you:

- High insurance coverage for Early Critical Illness and Critical Illness

- High insurance coverage against multiple claims of Critical Illness of all stage

- High insurance coverage against recurrent severe Critical Illness

- Lower initial premium compared to other types of insurance policies

- Looking to boost insurance coverage or fill shortfalls in an insurance portfolio

Singlife Multipay Critical Illness may not be suitable if you are looking for

Singlife Multipay Critical Illness may potentially be a bad fit if the following matters to you:

- Long-term cash accumulation

- Regular cash payout

- A one-time premium commitment with no further cash commitment

- Insurance policy with a surrender value.

Further considerations on Singlife Multipay Critical Illness

- How is Singlife or Singlife Multipay Critical Illness payout and claims based on past track record?

- How does Singlife Multipay Critical Illness compare with Term policies from other insurance companies?

- Can Singlife Multipay Critical Illness fulfill my financial, insurance, health, and protection needs?

The above information may not fully highlight all the product details and features of Singlife Multipay Critical Illness. Talk to us or seek advice from a financial adviser before making any decision about Singlife Multipay Critical Illness.

Always ensure your long-term financial goals and objectives are aligned with the financial product you are considering taking up.

Is Singlife Multipay Critical Illness suitable for me?

Contact InterestGuru using the form below. Our panel of licensed financial advisers will advise accordingly, based on your financial profile and protection needs.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

*For a limited time, get attractive incentives when you take up any products that is proposed by our team of financial planners.

We compare quotations head to head on all leading insurers in Singapore