What is compounding returns?

Simply put, compounding is the ability of an asset to generate returns on it own, after which the generated returns are left to generate additional returns. In other words, compounding is the increase in the value of an asset over time.

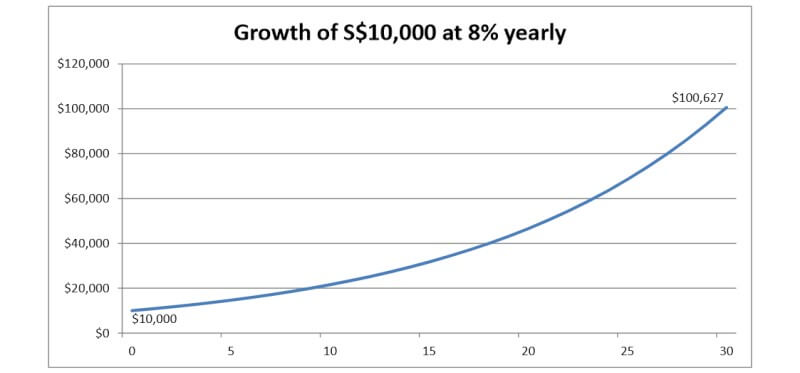

Assuming an investment grows at 8% annually over a 30 year period:

An initial lump sum of S$10,000 will grow to S$10,800 in the first year. If left untouched, the initial funds will grow to S$11,664 at the end of two years, as the S$800 returns earned in the first year continue to grow along with the initial investment.

Fast-forward to 30 years later, the initial capital has grown to S$100,627. Not too bad considering the initial investment is only S$10,000. Now, imagine the total returns if funds are added on a regular basis.

Read about: How can I accumulate a million dollar (Realistically)

Start early to maximise returns

Time and rate of returns are essential components when looking at the effects of compounded returns as compounding work best over a longer time horizon. Instead of catering a higher initial sum, setting aside a lower amount earlier may generate a higher rate of returns.

Let us use the examples of Michelle and David, both at age 30 to illustrate the effect of compounding returns on their financial goals and retirement.

Effect of compounding returns over a long time horizon (Saving regularly)

Scenario-based on retirement

Michelle started at age 30 and decided to set aside S$500 monthly until age 55 and let the fund generate returns for another 10 years until she is aged 65, before drawing down from it. David started at age 45 and decided to set aside S$1,500 monthly until age 65, to make up the loss of compounding effect for the earlier years.

All other factors considered equal and assuming the rate of return at 8% p.a.

Results

- Michelle would have set aside S$150,000 and the funds would have accumulated to S$438,635 by age 55. By age 65, the funds would further compound into S$946,981, which is approximately 6 times of her total initial funds.

- David would have set aside S$360,000 and by age 65 and expect a sum of S$823,715, approximately 2.3 times of his total initial funds.

Read about: Why you should start planning for retirement now

Effect of compounding returns over a long time horizon (Lump sum)

Scenario-based on retirement

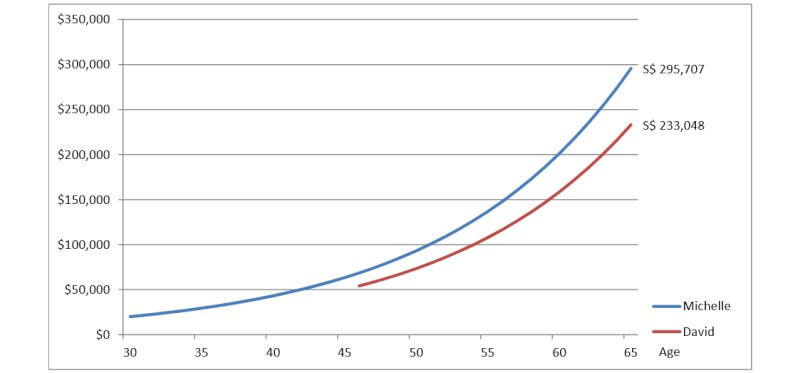

Michelle started at age 30, placing a one-time lump sum of S$20,000. David having started later at age 45, decided to place a lump sum of S$50,000 to make up the loss of compounded returns.

All other factors considered equal and assuming the rate of return at 8% p.a.

Results

- Michelle will be looking at S$295,706 at age 65, approximately 14.7 times her initial investment amount.

- David should expect S$233,048 at age 65, approximately 4.6 times his initial investment.

Despite an initial capital sum 2.5 times higher than Michelle, David total returns are lower than Michelle as Michelle lower initial funds have a longer period to compound for returns.

Read about: The Complete Retirement Planning Guide for Singapore (2023 Edition)

Read about: 3 Best Retirement Annuity Plans in Singapore for High Income Payout (2023 Edition)

Effect of compounding returns over a shorter time horizon (Saving regularly)

Scenario-based on fulfilling specific financial goals

Michelle and David are planning for a lump sum of S$80,000 in 22 years time for their child education and other personal financial goals. Michelle decided to start immediately, while David feels that he wish to start 10 years later when his income is higher so that he does not have to cut down on existing expenses.

All other factors considered equal and assuming the rate of return at 5% p.a. due to lower risk tolerance.

Results

- At S$200 monthly and a total saving amount of S$52,800, Michelle would have accumulated $92,412 due to compounding returns.

- David started 10 years later and saved S$420 monthly. He would be looking at S$79,585 despite saving up S$60,000 (S$5,000 x 12 years) for the same financial goal.

Read about: 3 Best Investment Linked Policies in Singapore for Wealth Accumulation (2023 Edition)

Effect of compounding returns (Based on Interest rates)

Scenario-based on general saving purposes:

Michelle and David individually have different risk tolerance and accumulate wealth using different financial instruments. They both started at the same age with the same amount of S$6,000 yearly over a 20 years time horizon.

- David placed his funds in savings accounts and fixed deposits with an average yield of 1.5% p.a.

- Michelle spread her funds over insurance endowment policies and an investment portfolio of Unit Trust Funds with her average portfolio yielding 5.5% p.a.

Result

- David will be looking at financial returns of S$138,742.

- Michelle will be looking at S$198,394,

Despite saving the same amount of S$120,000 over the 20 years, Michelle would have achieved meaningful financial returns above inflation rates. David is unlikely to maintain his purchasing power with the financial returns gained over the past 20 years.

Read about: 3 Best Savings Endowment Plans in Singapore for Lifetime Wealth Accumulation (2023 Edition)

Read about: 3 Best Fixed Maturity Savings Endowment Plans in Singapore for Wealth Accumulation (2023 Edition)

The risk of low return

In the last example, David rate of return is relatively “risk-free” as saving accounts and fixed deposit is not subjected to much investment risks or price volatility. But comparing the gain of S$18,742 over a 20 year period, is David better off in terms of purchasing power or has inflation caused the value of his S$120,000 to depreciate in value?

Assuming an average inflation rate of 3%, the future value of the S$138,742 he had accumulated will be equal to the present value of just S$79,200. This would mean that what David can purchase will be based on the current value of S$79,200, due to inflation rate being higher than his compounded rate of returns.

Read about: 5 ways you can beat the effects of inflation

Read about: 3 Best Retirement Annuity Plans with inflation-proofed Payout (2023 Edition)

Manage your risk instead of avoiding it entirely

The key to achieving higher returns rates than inflation is all about diversifying and managing risks. Financial markets and investment returns come with inherited risk and market volatility, investment returns will fluctuate with dips and peaks. An investor should not be overly concerned with volatility due to market sentiments but focus on the long-term economic outlook and prospects.

Not taking any risk does not mean one will be more financially sound or stable in the long run, as time horizon and rate of returns have an equally significant impact on financial gains.

With careful planning and affordability both taken into consideration, one should look into making use of the effects of compounding returns to enhance their wealth. Set realistic financial goals and objectives with a wealth planner that can ensure your financial plans are reviewed periodically according to your needs.

Read also: 5 part guide about The Basic of investing

Contact us should you require additional information and we will get back to you on your questions as soon as possible.

Article published with permission from TheMoneyBlog.sg

Original article: https://themoneyblog.sg/2017/05/24/missing-out-on-compounding-returns/