The Real Cost of Not Having Health Insurance in Singapore (2025)

Think you don’t need health insurance in Singapore? You’re not alone — many assume our public healthcare system is enough. But in reality, not having adequate health coverage can leave you vulnerable to massive bills and limited treatment options.

Here’s what it really costs to go without insurance in Singapore in 2025 — and smarter ways to protect yourself.

💵 1. The True Cost of Hospital Bills in Singapore

Singapore has one of the best healthcare systems in the world — but it’s not free.

If you’re a Singaporean or PR, MediShield Life covers a basic portion of your bill. However, it:

Only covers subsidised wards (B2/C-class) in public hospitals.

Has claim limits (e.g., $800–$2,000/day for hospital stays).

Leaves you to pay the rest out of pocket unless you have Integrated Shield Plans (IPs) or other private insurance.

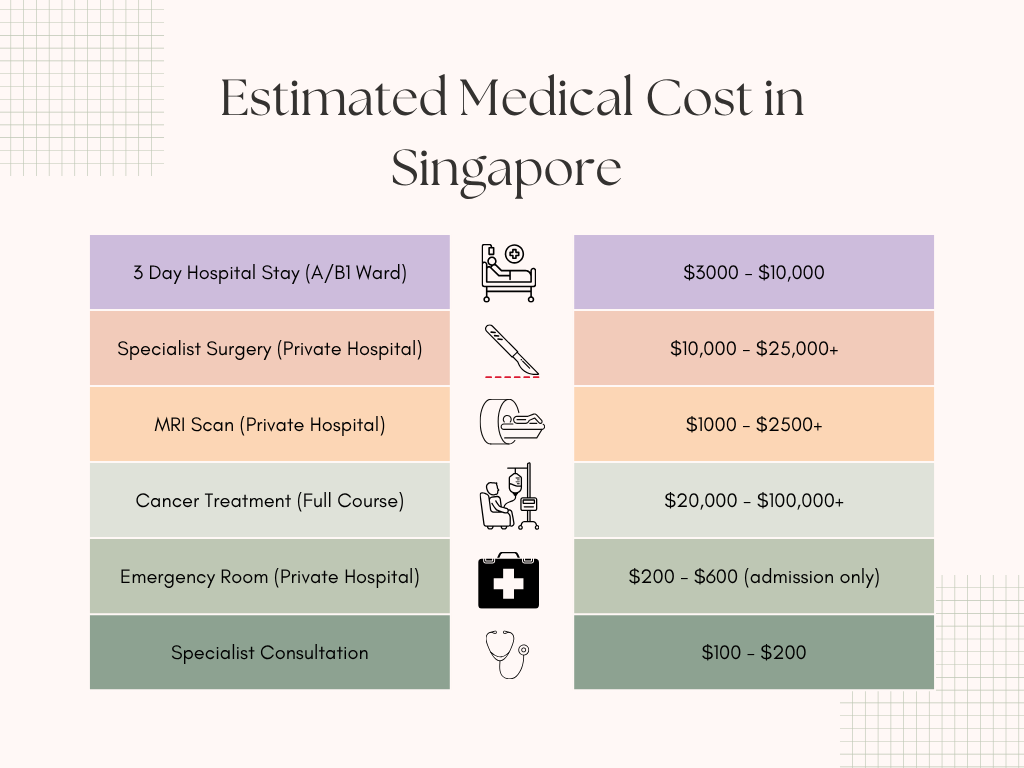

Here’s what you might pay without private insurance or enough Medisave:

🧾 Fact: If you opt for a private hospital or better-class ward, MediShield Life alone won’t be enough.

🕳️ 2. The Hidden Risks of Being Underinsured

Even if you’re young and healthy, skipping or delaying insurance in Singapore comes with serious risks:

Out-of-pocket burden: For non-subsidised care, bills can pile up fast.

Limited ward choice: Without IPs, you may be forced into lower-class wards, longer wait times.

No income protection: If you’re hospitalized and can’t work, there’s no payout unless you have personal accident or critical illness coverage.

Mental stress: Financial pressure + illness = double the burden.

📌 3. “I Have MediShield Life — Isn’t That Enough?”

MediShield Life is essential, but limited.

If you want:

Private hospital care

Faster access to specialists

More comfortable wards (A/B1)

Fuller cost coverage

👉 You need to upgrade to an Integrated Shield Plan (IP) — and possibly add riders for near full coverage.

Food for thought: If you are having your own air-conditioning room now, will you want to stay in a 8 bedder non-aircon room when you are sick?

Note: As of 2025, insurers are tightening underwriting. Getting insured before health issues arise is crucial.

Read more: Why is it important to get your insurance coverage while you are still young and healthy

🧠 4. What If I Can’t Afford Insurance Right Now?

There are still smart ways to stay protected:

Basic Integrated Shield Plans are affordable — often under $100/month.

Use MediSave to pay IP premiums partially.

Consider term plans with hospital income benefits, which pay you daily while you’re hospitalised.

If you’re self-employed, explore private medical or income protection policies.

Bonus Tip: Avoid delaying — the older you get, the more expensive (or harder) it becomes to get covered.

Read more: 4 Best Integrated Shield Plans in Singapore

🧾 Real-Life Scenario in Singapore

Jason, 35, self-employed

Skipped private insurance thinking he was “fit and healthy.”

After a bike accident, he needed surgery in a private hospital. The bill? $17,400. MediShield Life only covered $2,600.

He had to wipe out savings and take a loan — all avoidable with a basic IP and rider.

🧭 Final Thoughts: Insurance = Peace of Mind

In Singapore, medical bills don’t have to bankrupt you — but only if you’re prepared.

Don’t rely on luck or assume subsidies are enough.

Make sure your health insurance fits your lifestyle, ward preferences, and income.

📞 Need Help Choosing the Right Health Insurance Plan?

We help Singaporeans and PRs find the right Integrated Shield Plans, critical illness, and hospital income protection that suit their budget and goals.

👉 Contact us today for a free, no-obligation consultation. Let’s walk you through it—no cost, no pressure. Leave your contact details via the form below or Whatsapp us today!

Contact Us!

Or Whatsapp us to let a licensed financial adviser work out a proposal at no cost to you.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Our Partners

Our Partners