Whole Life Insurance

What is Whole Life Insurance?

Whole life insurance is a form of life insurance that offers coverage for your entire lifetime, provided you keep up with the premium payments.

Unlike Term Life Insurance, which covers you for a specific period, Whole Life Insurance combines a death benefit with a savings component. This savings component builds cash value over time.

Whole Life Insurance however, is generally more expensive than Term Life Insurance as it provides lifelong coverage and cash value component. As replacing or early terminating your Whole Life Insurance will result in financial losses, ensure that you have comprehensive coverage in your Whole Life Insurance policy, any future gaps in your insurance coverage shortfall can then be address using a Term Life Insurance.

Why Whole Life Insurance?

Whole life insurance is often introduced as a foundational plan for younger individuals, as it offers boosted coverage (Up to 5x) through a multiplier component. Premiums are payable for a limited period, ensuring they’re covered during your active working years and providing lifetime coverage.

Since Whole Life Insurance includes a cash value component, you can surrender the policy for cash upon reaching your retirement age for retirement needs when you no longer need the coverage.

Riders covering for Critical Illness, Total and Permanent Disablity or Premium Waiver can be added for a more comprehensive coverage on your Whole Life Insurance.

Compare Plans

Policy Term: 10 to 30 Years in Multiples of 5 Years

Multiplier: 2.5, 3.5, 4.5 or 6 times

Promotion: N.A.

Unique Features: Multiplier reduce by 10% every year upon reaching expiry age and stays at 50% for lifetime

Policy Term: 5 to 25 Years in Multiples of 5 Years

Multiplier: 2, 3, 4 or 5 times

Promotion: Up to 8% off 1st Year Premium

Unique Features: Multiplier reduce by 10% every year upon reaching expiry age and stays at 50% for lifetime

Policy Term: 5 to 25 Years in Multiples of 5 Years or Till Age 99

Multiplier: 2, 3 or 5 times

Promotion: 10% off 1st Year Premium, 1% Cash Rebates on Premium

Unique Features: Wide Range of Critical Illness Conditions covered with Critical Illness Rider, Multiplier reduce by 10% every year upon reaching expiry age and stays at 50% for lifetime

Policy Term: 10 to 25 Years in Multiples of 5 Years or Till Age 99

Multiplier: 1, 2, 3, 4 or 5 times

Promotion: 10% off 1st Year Premium, 1% Cash Rebates on Premium

Unique Features: Health Advantage Benefit, Retrenchment Benefit

Policy Term: 5 to 20 Years in Multiples of 5 Years

Multiplier: 1, 2, 3 or 4 times

Promotion: N.A.

Unique Features: Option to convert cash value as a stream of retirement income

Policy Term: 10 to 25 Years in Multiples of 5 Years or Till Age 65

Multiplier: 2, 3, 4 or 5 times

Promotion: N.A.

Unique Features: Retrenchment Benefit, ICU Care Benefit

Policy Term: 5 to 30 Years in Multiples of 5 Years or Till Age 64

Multiplier: 1, 2, 3, 4 or 5 times

Promotion: N.A.

Unique Features: Retrenchment Benefit, Family Waiver Benefit

Policy Term: 5 to 25 Years in Multiples of 5 Years

Multiplier: 1, 2, 3 or 4 times

Promotion: N.A.

Unique Features: Retrenchement Benefit. Option to convert cash value as a stream of retirement income

Sample Premiums

30 Years Old Non-Smoker

Death and Disability Coverage: $50,000

Early CI Coverage: $25,000

Mulitplier: 4x till Age 70 unless otherwise stated

Premium Term: 20 Years

| Insurer | Male Annual Premium | Female Annual Premium |

|---|---|---|

| Singlife Whole Life | $1,336.50 | $1,209.50 |

| HSBC Life - Life Treasure III (4.5X) | $1,607.75 | $1,363.25 |

| ChinaTaiping i-Secure Legacy II (Till 76) | $1,326.05 | $1,202.65 |

| FWD Life Protection (3x till 75) | $1094.50 | $1009.50 |

| Etiqa Essential Whole Life Cover (Till 65) | $1,208.60 | $1,131.53 |

| NTUC Income Star Secure (Till 75) | $1205.70 | $1101.90 |

| Manulife LifeReady Plus II | $1,390.03 | $1,319.27 |

| China Life Whole Life Multiplier Guardian | $2,797.50 | $2,437.00 |

Contact Us!

Our Partners

Our Partners

Whole Life Insurance Posts

Do I Need Critical Illness Insurance in Singapore? (An Honest 2026 Answer)

Do I need critical illness insurance in Singapore? This is a common question among working adults...

- January 14, 2026

Whole Life Insurance Singapore: Is It Worth It? Compare Plans & Premiums

Whole Life Insurance in Singapore: Is It Really Worth It? Whole life insurance is one of...

- December 17, 2025

Life Insurance for New Parents Singapore: Complete Protection Guide (2026)

Your Baby Changes Everything - Including Your Insurance Needs Welcoming a child is one of life’s...

- February 13, 2026

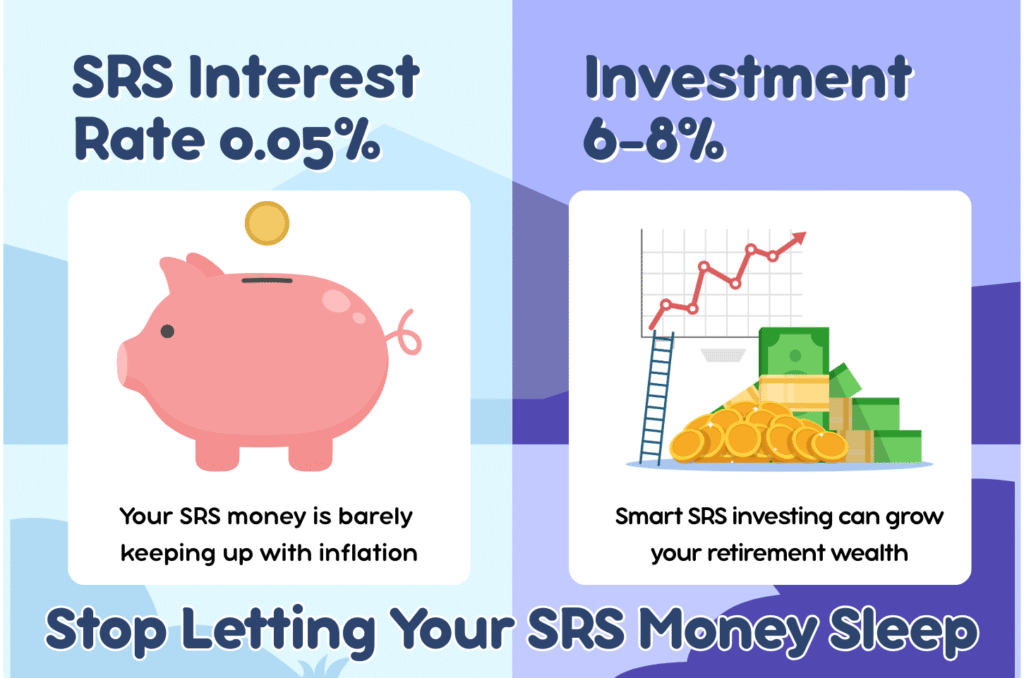

Best SRS Insurance Plans in Singapore for Retirement Planning 2026

Why Your SRS Account is Losing Money — And How SRS Insurance Plans in Singapore Can...

- February 13, 2026