You already have MediShield Life — so do you really need to pay extra for an Integrated Shield Plan (ISP)?

With healthcare costs rising in Singapore and hospital bills easily crossing five digits, this guide helps you understand whether an Integrated Shield Plan (ISP) is worth it in 2025, how much it costs, and who really needs one.

What Is an Integrated Shield Plan?

All Singapore Citizens and Permanent Residents are automatically covered under MediShield Life, the national health-insurance scheme that helps pay for large hospital bills in public hospitals. However, MediShield Life only covers basic treatments in B2 or C-class wards.

An Integrated Shield Plan (ISP) is an optional private-insurance add-on that increases your coverage limits and gives you access to A/B1 wards or private hospitals.

The ISP combines MediShield Life (run by CPF Board) and a private-insurance component from one of the approved insurers:

AIA HealthShield Gold Max

Great Eastern SupremeHealth

Prudential PRUShield

HSBC Life Shield

Singlife Shield (formerly Aviva MyShield)

NTUC Income Enhanced IncomeShield

Raffles Shield

Your premiums are split: part goes to CPF for MediShield Life, and the rest to your insurer for enhanced coverage.

What MediShield Life Covers — and Its Limits

MediShield Life is designed for basic, subsidised care.

Here’s what it offers — and what it doesn’t:

| Coverage Type | MediShield Life (CPF Board) | Integrated Shield Plan (Private Insurer) |

|---|---|---|

| Hospital Ward | B2 / C class (public) | A, B1, Private hospital (choice) |

| Annual Claim Limit | Up to $200,000 | Up to $2 million (varies by insurer) |

| Pre/Post-Hospitalisation | Limited | 90 –365 days (before/after) |

| Specialist Choice | Assigned doctor | Choose your own specialist |

| Co-Payment | 3 – 10 % | 5 – 10 % with rider |

| Premiums | Paid via MediSave | Paid via MediSave + Cash |

Source: Ministry of Health

Example:

A 5-day private-hospital stay can cost around $20,000–$35,000.

MediShield Life may cover only $2,000–$3,000, leaving you to pay the rest — unless you have an Integrated Shield Plan.

💬 Tip: MediShield Life is essential, but it’s not designed for private-hospital comfort or higher-class wards.

Why Consider an Integrated Shield Plan

An ISP isn’t mandatory — but for many Singaporeans, it’s a practical safeguard against large bills.

1️⃣ Access to Private or A-Class Public Hospitals

You can choose your preferred hospital, specialist, and treatment schedule without relying on referral systems.

2️⃣ Higher Claim Limits

Annual limits can reach $2 million, depending on the insurer, allowing for full-coverage major procedures.

3️⃣ Shorter Waiting Times

Private facilities offer faster admission and elective-surgery scheduling.

4️⃣ Add Riders for Cashless Hospitalisation

Optional riders reduce or eliminate cash out-of-pocket payments during admission (subject to 5 – 10 % co-pay).

5️⃣ Peace of Mind for Families

Knowing your child or parents can receive timely, quality care brings emotional comfort that’s hard to quantify.

When You Might Not Need an Integrated Shield Plan

ISPs aren’t for everyone. It depends on your budget, health, and hospital preference.

You might choose to skip or downgrade your plan if:

You’re satisfied with B2/C-class public-hospital care.

Your employer’s group insurance already provides comprehensive cover.

You’re older (70 +) and premiums feel heavy relative to your usage.

You’re managing tight finances and prioritising other essential policies.

💬 Reality check: Downgrading later can save money — but re-upgrading usually requires medical underwriting, so switching back may not be possible.

How Much Does an Integrated Shield Plan Cost in 2025?

Premiums depend on your age, ward class, and insurer.

Here’s a simplified estimate (non-smoker, restructured-hospital plan):

| Age | MediShield Life (CPF) | ISP Enhancement (approx.) | Total Premium (before rider) |

|---|---|---|---|

| 30 | $145 | $150 – $200 | ≈ $300 – $350 |

| 40 | $230 | $250 – $350 | ≈ $500 – $600 |

| 50 | $375 | $500 – $650 | ≈ $900 – $1,000 |

| 60 | $525 | $800 – $1,200 | ≈ $1,300 – $1,700 |

💡 MediSave limits:

You can use MediSave up to the Additional Withdrawal Limit (AWL) — $300 – $900 per year depending on age. Anything above must be paid in cash.

🧾 Pro Tip: Always review your insurer’s premium-projection table, as rates increase with age and medical inflation.

How to Choose the Right Integrated Shield Plan

1️⃣ Decide on Your Preferred Hospital Class

Private vs Public (A/B1 wards).

Public-hospital plans are more affordable yet still offer good comfort.

2️⃣ Check the Insurer’s Panel Network

Non-panel doctors may mean lower coverage or higher co-pay.

Choose insurers with wide specialist panels.

3️⃣ Review Rider Options

Most riders now require at least 5 % co-payment (MOH directive).

Look for perks such as Health Rewards or claim-free discounts.

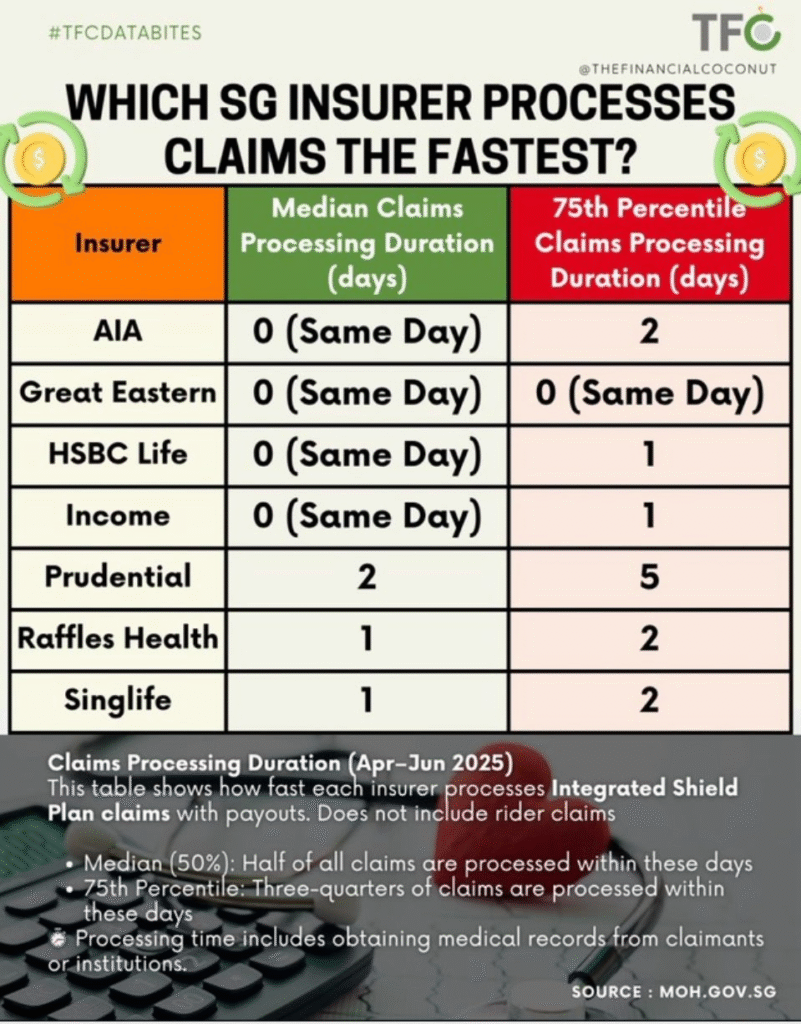

4️⃣ Compare Renewal & Claim Processes

Some insurers have faster digital claims or direct-billing arrangements with hospitals.

👉 Read next: 3 Best Integrated Shield Plans in Singapore

Frequently Asked Questions

Q1: Is MediShield Life enough in Singapore?

MediShield Life provides basic protection for subsidised wards. If you prefer private hospitals or shorter waiting times, you’ll likely need an ISP.

Q2: Can I pay ISP premiums with MediSave?

Yes, up to the Additional Withdrawal Limit (AWL). Riders must be paid in cash.

Q3: Should I downgrade my plan as I age?

Yes, if premiums feel high relative to your income or you’re comfortable in public hospitals.

Q4: What happens if I stop paying?

Your ISP portion lapses, but MediShield Life continues since it’s mandatory for all Singapore residents.

Summary — Who Really Needs an Integrated Shield Plan?

| Profile | Recommendation |

|---|---|

| Private hospital preference | ✅ Strongly recommended |

| A/B1 public-hospital user | 👍 Recommended |

| B2/C public ward user | 🤔 Optional |

| Fully covered employee | 🟡 Optional |

| Retiree with savings | ✅ For peace of mind |

Final Thoughts

Healthcare inflation in Singapore averages 8 %–10 % annually. Without an Integrated Shield Plan, a single hospitalisation could deplete years of savings. But if you rarely use private care and prefer subsidised treatment, MediShield Life may already meet your needs.

Ultimately, the right answer depends on your budget, risk tolerance, and lifestyle preferences.

Ready to Review Your Coverage?

Not sure if your current plan still fits your needs?

Get a free Integrated Shield Plan Review — we’ll compare premiums, riders, and coverage across all major insurers so you can make the best decision for 2025.

Ready to protect your financial future?

The best time to buy life insurance was yesterday. The second-best time is today. Don’t let another day pass without insuring yourself.

Whatsapp us or fill in the form below to discuss your specific needs and get personalized recommendations for the best integrated shield plans in Singapore.

Remember: This guide provides general information only. Everyone’s situation is unique, and you should seek professional financial advice tailored to your specific circumstances.

Contact Us!

Or Whatsapp us to let a licensed financial adviser work out a proposal at no cost to you.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

We compare quotations head to head on all leading insurers in Singapore

Our Partners

Our Partners