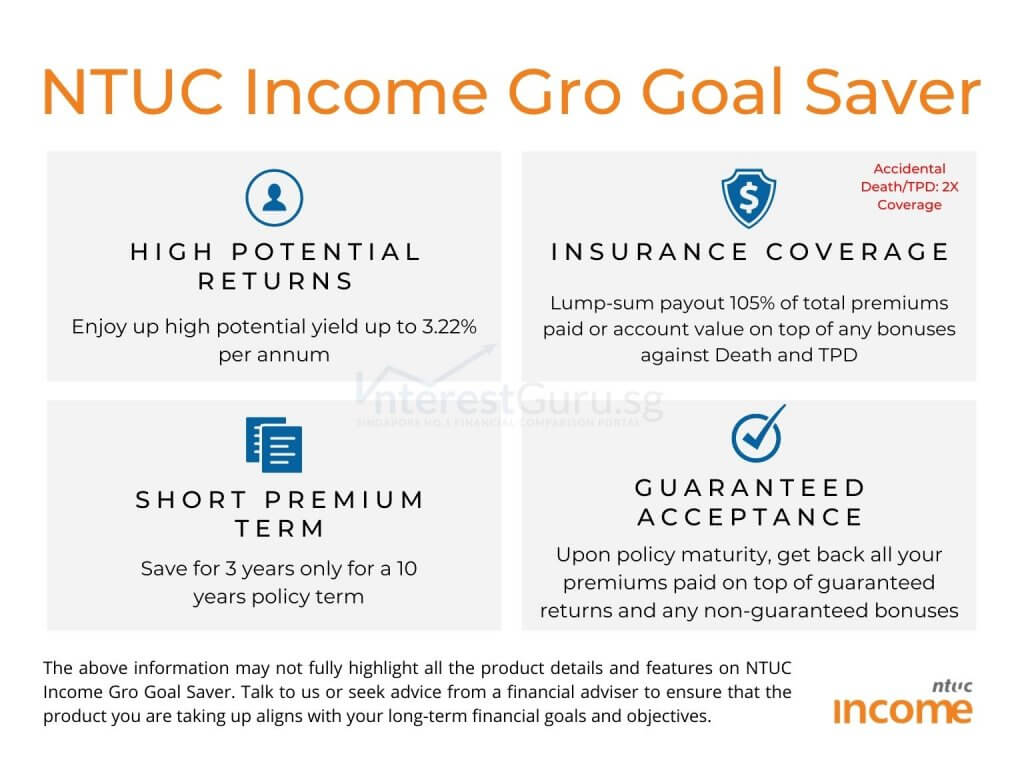

NTUC Income Gro Goal Saver is a limited premium term insurance savings plan where you only need to pay premiums for the first 3 years of the policy. With a fixed maturity on the 10th policy year, NTUC Income Gro Goal Saver provides a boost to your savings for your short to mid-term financial goals.

Note: NTUC Income RevoEase has been rename to NTUC Income Gro Goal Saver. There is no material change to product illustration or benefits.

NOTE: NTUC Income Gro Goal Saver has been phased out and is no longer available. The latest updated and upgraded version is NTUC Income Gro Power Saver.

NTUC Income Gro Goal Saver product details

NTUC Income Gro Goal Saver is featured for Shortest premium term (3yrs) in our 7 Best Regular Insurance Savings Plans in Singapore (2023 Edition)

- Life policy – Endowment and Saving policy

- Premium & Policy Term

- Pay premiums for 3 years only for a policy term of 10 years

- Capital Guaranteed

- Upon policy maturity, receive all the premiums paid on top of guaranteed returns and non-guaranteed bonuses if any

- Insurance Coverage

- Receive 105% of premiums paid plus any bonuses against Death and Total and Permanent Disability (TPD)

- Receive 2x coverage if the cause of Death or TPD is accidental

- Hassle-free Application

- Guaranteed acceptance, no health questions asked

Read about: Endowment and Saving policy: How does it work?

Read about: Is an endowment savings plan the best option for wealth accumulation?

Features of NTUC Income Gro Goal Saver at a glance

Cash and Cash Withdrawal Benefits

- Cash value: Yes

- Cash withdrawal benefits: No

Health and Insurance Coverage

- Death: Yes

- Total Permanent Disability: Yes

- Terminal Illness: No

- Critical Illness: No

- Early Critical Illness: No

Health and Insurance Coverage Multiplier

- Death: Yes, if the cause of death is accidental

- Total Permanent Disability: No

- Terminal Illness: No

- Critical Illness: No

- Early Critical Illness: No

Optional Add-on Riders

- Cancer Premium Waiver

Additional Features and Benefits

Yes.

For further information and details, refer to NTUC Income website. Alternatively, fill-up the form below and let us advise accordingly.

Read about: Effects of compounding returns on your saving

Read about: Where do I start with financial planning

Policy Illustration for NTUC Income Gro Goal Saver, John

John, age 25, purchase NTUC Income Gro Goal Saver to save for the year-long travel of his dreams. John pays S$30,000 yearly for the next 3 years with a 10 years policy term.

John finishes premium payment on the 3rd policy year where a total of S$90,000 has been paid.

NTUC Income Gro Goal Saver matures on the 10th policy year where John turns 35. He receives a projected lump-sum payout of S$119,780.

Of the total projected payout, S$94,619 is guaranteed, and S$25,162 is non-guaranteed.

NTUC Income Gro Goal Saver may be suitable if you are looking for

NTUC Income Gro Goal Saver may potentially be a good fit if the following matters to you:

- To save for a short term of 3 years

- A hassle-free application without medical underwriting

- Insurance coverage against Death and Total and Permanent Disability

- 2X coverage if the cause of death is accidental

- Short endowment and savings plan

- Saving for a goal you wish to achieve 10 years later

- To potentially generate higher financial returns compared to bank accounts

Read about: 3 things to consider before taking up a new financial product

NTUC Income Gro Goal Saver may not be suitable if you are looking for

NTUC Income Gro Goal Saver may potentially be a bad fit if the following matters to you:

- Health and Protection coverage

- High insurance coverage for Death or Total and Permanent Disability

- Insurance coverage for Early Critical Illness, Critical Illness

- Lifetime regular cash payout

- Liquidity or flexibility of withdrawal in your Insurance policy.

- A one-time premium commitment with no further cash commitment

- Potentially higher financial returns compared to a pure investment product.

- Insurance policy with a high surrender value in the early years of the policy.

Read about: How much life insurance coverage do you need?

Read about: 5 ways to overcome inflation on your savings

Further considerations on NTUC Income Gro Goal Saver

- How is NTUC Income or NTUC Income Gro Goal Saver investment returns based on historical performance?

- How does NTUC Income Gro Goal Saver compare with Endowment policies from other insurance companies?

- Can NTUC Income Gro Goal Saver fulfill my financial, insurance, health, and protection needs?

The above information may not fully highlight all the product details and features on NTUC Income Gro Goal Saver. Talk to us or seek advice from a financial adviser before making any decision about NTUC Income Gro Goal Saver.

Always ensure your long-term financial goals and objectives are aligned with the financial product you are considering to take up.

Read about: How can I accumulate a million dollar (Realistically)

Read About: 3 best Savings plans and endowment policies in Singapore (updated Jan 2023)

Is NTUC Income Gro Goal Saver suitable for me?

Contact InterestGuru using the form below. Our panel of licensed financial advisers will advise accordingly, based on your financial profile and protection needs.

All financial reviews and proposals provided are 100% free of charge. There will be no obligation to take up any proposed financial products or services in any way.

*For a limited time, get attractive incentives when you take up any products that is proposed by our team of financial planners.

We compare quotations head to head on all leading insurers in Singapore