Retirement will come, be it due to personal choice or old age. Make it your choice when you start to plan and budget for your golden years. We promise that there is no better time than now when it comes to working on your retirement plans.

In this retirement guide, we will go in-depth into how you can find the right retirement plans to fit your retirement lifestyle needs. Following on that, we will explain additional features that enhance your income stream. Lastly, we will finish off the guide with how you can get the maximum financial returns from your retirement plans.

Feel free to jump to the most relevant section:

- Finding the right retirement plans

- Additional benefits for your retirement plans

- Getting the most out of your retirement plans

Finding the right retirement plans

Think of a retirement plan as an investment that you built up with savings while you work. Upon retirement, your plan takes over to provide an income stream based on how it was previously structured. While all retirement plans can be a replacement for your loss of income, how it pays out can greatly differ depending on your preferences.

With a fixed savings budget, which retirement income option is the most attractive to you?

- Getting the highest income payout for a fixed period of years

- Getting a lower income payout that lasts for your entire lifetime

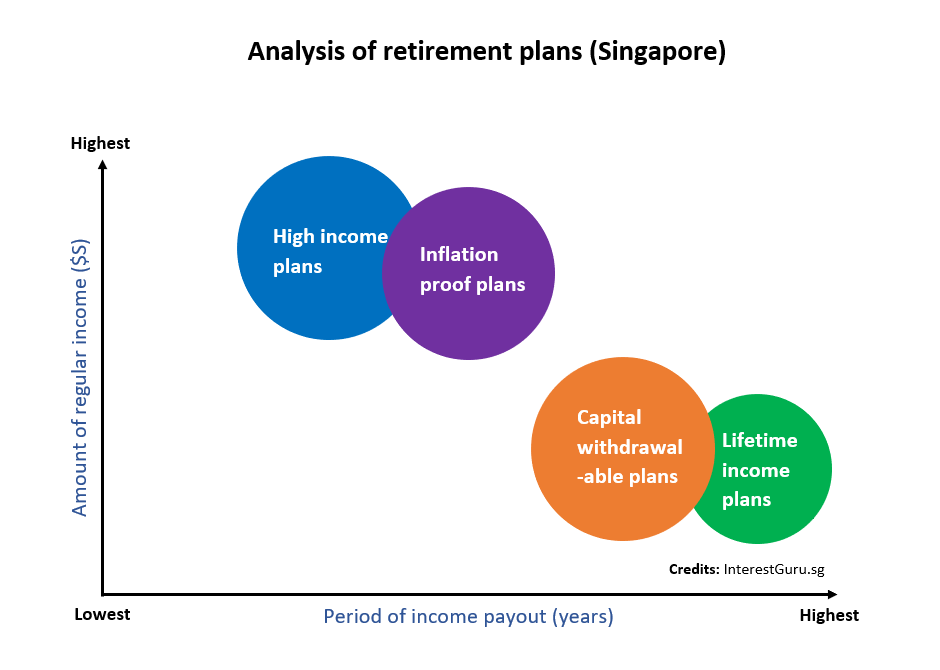

Refer to the chart below for the retirement plans that provide the best fit for your income payout preferences:

It is also important to choose the right type of retirement plans based on your lifestyle needs and expenses. After all, you get to know how much to save and what you are getting in return.

Next, we will go into an in-depth review into the key benefits and features on the 4 categories of retirement plans.

High income retirement plans

High income retirement plans provide the highest regular payouts over a fixed period of years. This category of retirement plans is useful to boost your income stream during the initial years of your retirement.

By maximising your income at your retirement peak, you can fully open up your lifestyle options with minimally financial constraints. Use this range of retirement plans to complement your CPF LIFE payouts.

Key features of High income retirement plans

- Get the highest regular income stream upon your retirement

- Income payout usually lasts for 10 to 20 years

- Usually comes with an income multiplier in the event of disability

- Carry the risk of outliving your income stream

Learn more about this category of retirement plans in our 3 Best Retirement Plans in Singapore for Highest Income Payout (2023 Edition)

Inflation-proof retirement plans

Increasing cost of living will certainly cause prices of everyday goods and services to go up. An inflation-proof retirement plan is best suited on maintaining your purchasing power.

For the same amount of savings budget, expect a lower initial payout when compared to a high income retirement plan. In return, expect your retirement income to keep up with inflation due to a guaranteed increase in payouts over the years.

Key features of Inflation proof income plans

- Lower initial retirement income

- Retirement income is guaranteed to increase over the years

- Income payout usually lasts for a maximum of 25 years

- Carry a slight risk of outliving your income stream

- Comes with non-guaranteed lump sum together with your final income payout

Learn more about this category of retirement plans in our 3 Best Retirement Plans in Singapore for Inflation Proof Payout (2023 Edition)

Capital withdrawal-able retirement plans

We all understand that life is unpredictable, and so are your finances. Capital withdrawal-able retirement plans allow you to receive a regular payout as long as you hold on to the policy.

You can choose to cash out on your policy anytime and get back all the premiums paid previously for the plan. A disadvantage of such retirement plans would be a lower income stream, due to the guaranteed liquidity on your capital/ principal savings.

Key features of capital withdrawal-able retirement plans

- Slightly lower retirement income

- Income payout last for as long as you hold on to the insurance policy

- The policy can be surrendered to get back the full initial premium

Learn more about this category of retirement plans in our 3 Best Retirement Plans in Singapore with Capital Withdrawal-able Features (2023 Edition)

Lifetime income retirement plans

The assurance of a lifetime payout ensures that your finances will last you as long as you live. A lifetime income retirement plan does exactly what it says, providing an income stream to your final living days.

This range of insurance policies can also be purchased with joint ownership, with your spouse receiving a lifetime of income stream even in your demise. Due to the lower payout, these plans may not be suitable if you are expecting high expenses in your early retirement years.

Key features of Lifetime income retirement plans

- Significantly lower retirement income (Similiar to CPF LIFE)

- Income payout will last for a lifetime

- Income payout can continue for your spouse even after your demise

- Inflation may erode spending power in the later years

Learn more about this category of retirement plans in our 3 Best Retirement Plans in Singapore with Lifetime Income (2023 Edition)

Additional features of your retirement plans

Your CPF LIFE payout will ensure that your basic living needs are taken care of. On the other hand, retirement plans provide a source of disposable income to meet your individual lifestyle needs. It goes without saying, having a higher retirement income open up more lifestyle options.

- Basic living needs – Food and clothing, utilities, telecommunication, etc

- Individual lifestyle needs – Dining, travel, healthcare upgrades and other discretionary spendings

However, life situations may bring about additional unforeseen financial commitments. Disability may result in an additional financial commitment that lowers your “free” income. Similarly, other family and personal issues may call for the need for a lump sum of cash.

Consider disability-related and lump sum payout features to provide a financial buffer during your retirement.

Disability-related features

The following built-in disability features ensure that even if your health deteriorates, you can still maintain your lifestyle and income during your retirement.

- Disability income multiplier benefit

- Disability lump-sum payout benefits

- Premium waiver riders

The features stated above may not be applicable or available for all retirement plans.

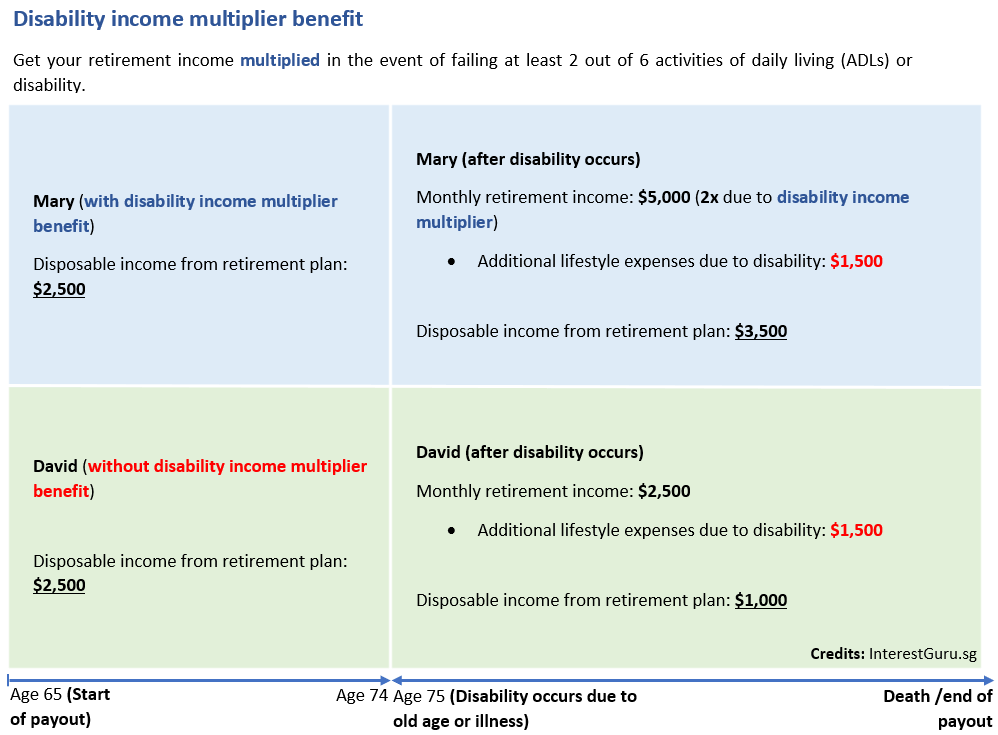

Disability income multiplier benefit

While not as life-threatening compared to major illness, disability takes a heavy toll on your finances and savings. Ensure that disability does not reduce your retirement income with a disability income multiplier rider.

The cost of a full-time caretaker and adjustment to living may easily be in the thousands due to disability. With disability income multiplier benefit, your retirement income is doubled upon failing at least 2 or 3 activities of daily living.

Disability lump-sum payout benefits

Receive a lump sum payout in the event you are permanently disabled. This disability payout is claimable even as you are paying your premiums or before your retirement payout age.

Premium waiver riders

Look out for a range of riders to waive off future premiums in the event of Critical Illness or Disability. Even with your premiums waived, you will still receive your retirement income upon reaching your desired retirement age.

Lump sum payout features

The following features allow a lump sum cash payout upon reaching a specific age or period or the triggering of certain policy conditions.

The features stated below may not be applicable or available for all retirement plans.

Upfront lump sum payout

Start your retirement with an expensive and well-deserved celebration. Some retirement plans may offer a full or partial lump sum payout when you reach your retirement payout age. Your upfront payout may or may not reduce your monthly income payout.

Maturity lump sum payout

Worried about outliving the payouts from your retirement plan? A maturity lump sum paid out together with the final monthly income allows a buffer for such events.

Lump sum payout upon surrendering

Looking for absolute liquidity on the premiums or savings that you have set aside for your retirement plans? Some plans may allow you to surrender your retirement policy to get a lump sum cash (Similar to Capital withdrawal-able retirement plans).

Learn more about securing your retirement income in our 5 Best Insurance Plans in Singapore for Retirement Income (2023 Edition)

Getting the most out of your retirement plan

By now, you may be deciding on the retirement plans that better fits into your retirement lifestyle. Before that, look into further optimisation on your retirement income policy for higher returns.

Within your savings budget, explore the following policy options on your retirement plan:

Premium term of the retirement plan

If a lump sum budget is available, placing your funds in a single premium or over 5 years will always yield the highest financial returns. This option is usually not suggested by a financial planner due to the lower remuneration for a short premium payment term.

For the same amount of savings (annual premium), changing to a shorter payment period (premium terms) may result in higher total returns of up to 40%.

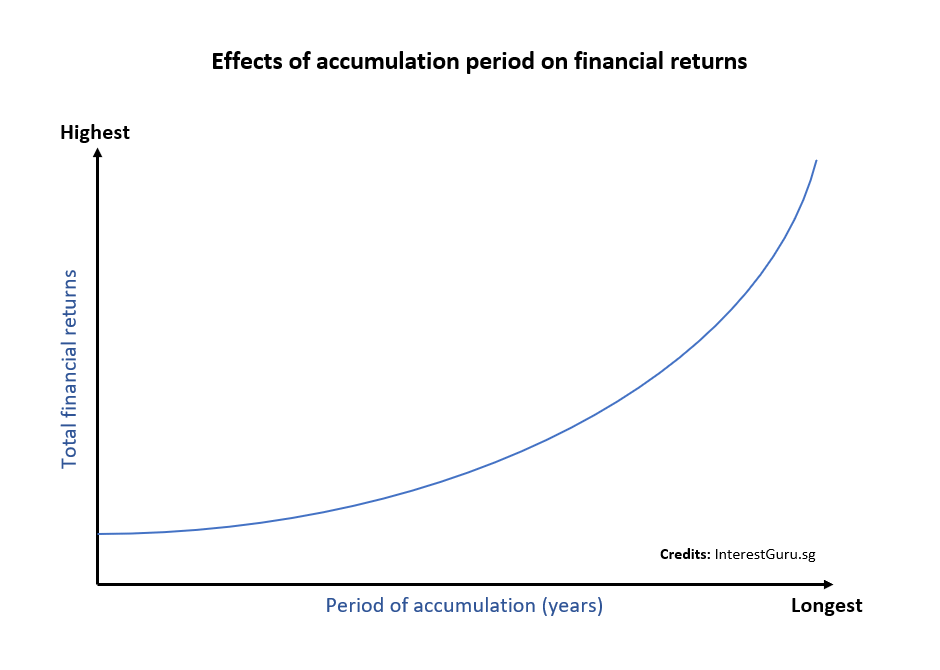

Accumulation period of the retirement plan

Just like any other investment, the effects of compounding returns cannot be underestimated. As a general guide, every 5 years of deferred retirement payout increases your total financial returns by up to 20%.

Retirement plans that pay cashback or cash benefit options before your retirement age also reduces your compounded returns. Even if you choose not to withdraw and accumulate the cashback, your overall returns will be lower compared to a plan that locks in all liquidity until your retirement.

Lastly, when it comes to accumulating your savings for retirement, do not forget about your SRS account. With an interest rate of 0.05%, your savings will be better off in an SRS approved retirement plan.

Find out your retirement income based on your budget

Like to know the actual financial returns of specific insurance retirement plans based on your age, budget and financial profile?

We are certain that you will find your ideal retirement income plans via our retirement plans portal. Go ahead, give it a try.

Let us find the best retirement income plans for you!

Our partnered financial planners will draft their proposals based on your given input. Your information and details will only be used for communication with you.

All comparisons done are strictly confidential and solely based on your individual retirement needs.

*For a limited time, get attractive incentives when you take up any product that is proposed by our team of financial planners.

Compare retirement income plans across all leading insurers in Singapore!

Let us work out your ideal retirement planning needs together with you

Drop us a message or learn more from our complete guide to retirement planning.

Alternatively, check out another 5 reasons why you should invest in a retirement annuity plan.

Note: All financial figures are based on close approximate and all non-guaranteed figures are based on the higher tier of 4.75% investment returns. The sample illustrations are for illustrative purposes only and is not a contract of insurance. Early surrendering or cashing out from Retirement plans or Annuity policies will certainly result in financial loss. In the event of doubt, always refer to the precise terms and conditions as specified in your policy contract. Seek the advice of a qualified financial professional or a licensed financial adviser before making any decision or financial commitment.

*Terms and conditions may apply, speak to our financial planners or drop us a message for more details.